What Is the Long/Short Ratio? How to View Long/Short Ratio Data in Futures Trading?

1. What Is the Long/Short Ratio?

2. What Are the Benefits of Understanding the Long/Short Ratio?

- Gauge market sentiment: Quickly identify whether the market is leaning bullish or bearish, helping to avoid blindly following trends.

- Support trading decisions: When combined with candlestick patterns and trading volume, the ratio can help confirm buy or sell signals.

- Risk management: In periods of extreme sentiment, it helps identify potential reversal risks and reduce the likelihood of being trapped in adverse positions.

- Strategy optimization: Whether trading short-term or long-term, the long/short ratio serves as a valuable reference indicator to improve the consistency and reliability of trading strategies.

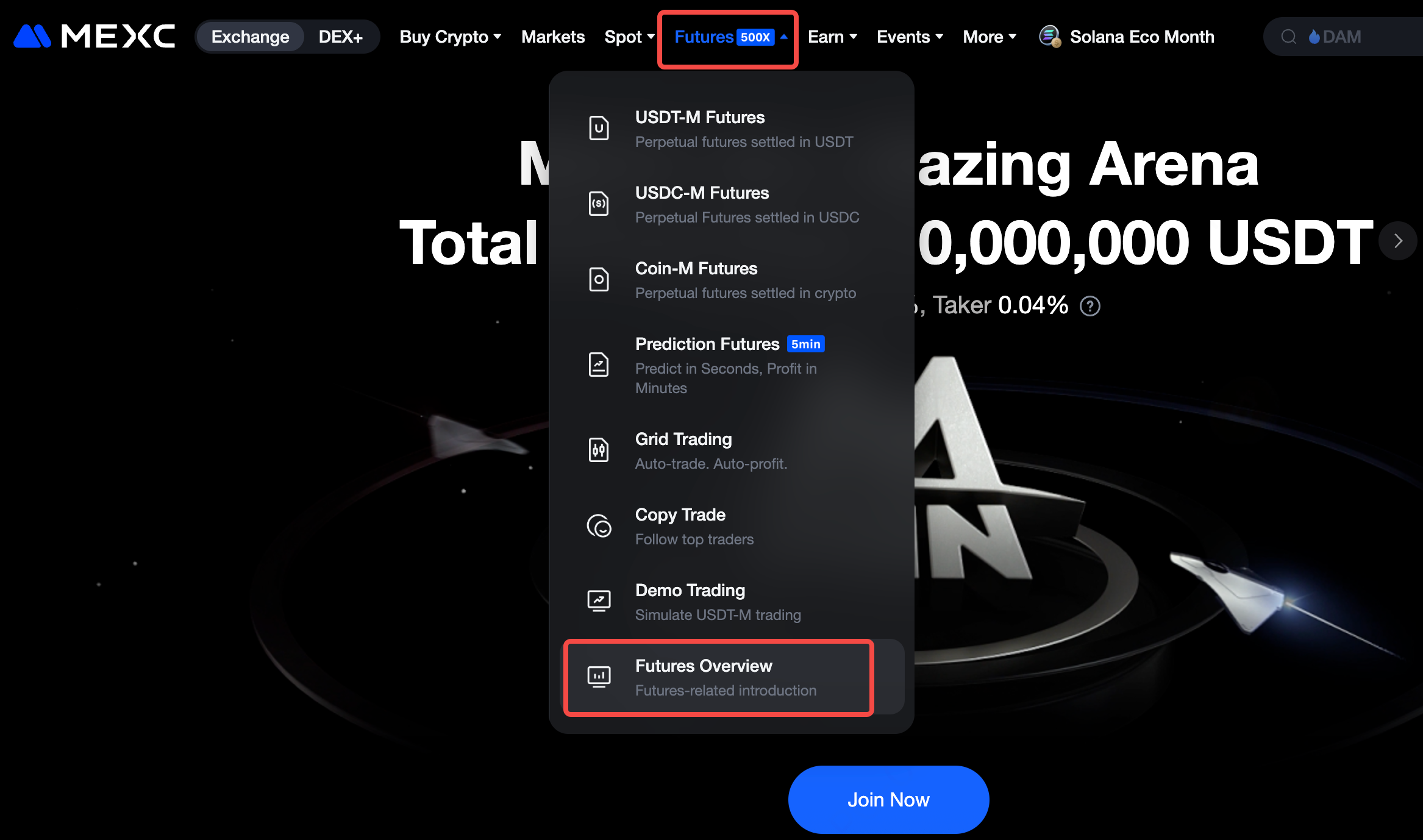

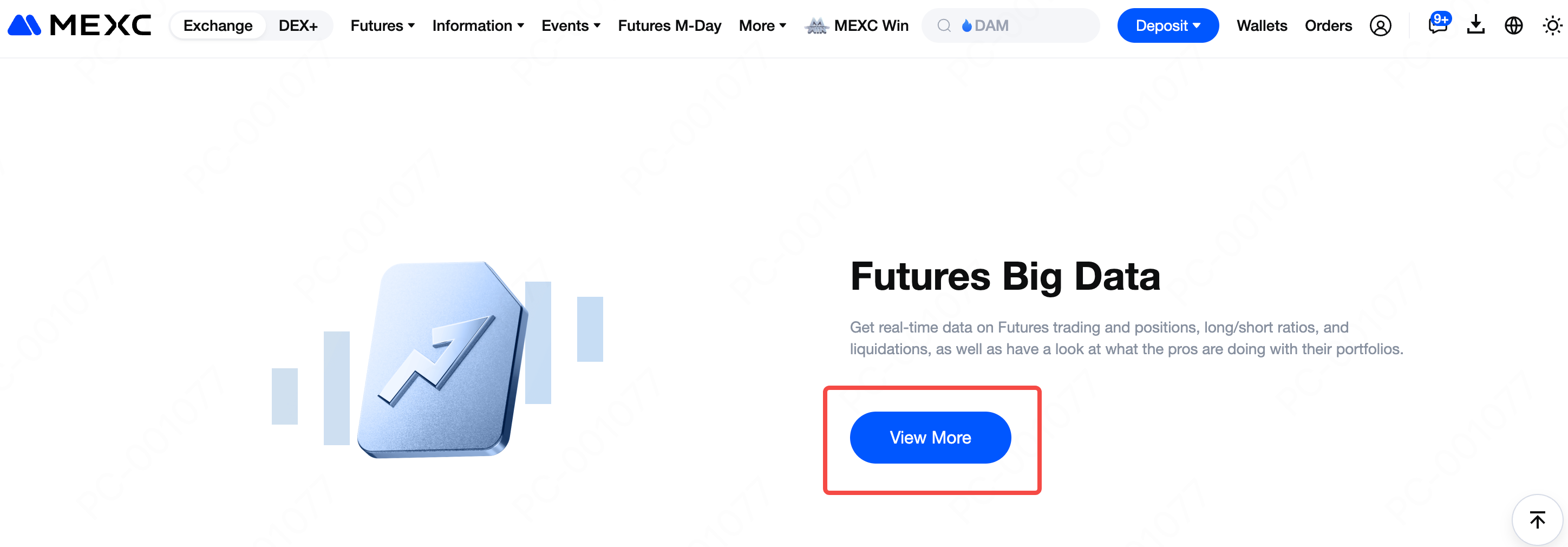

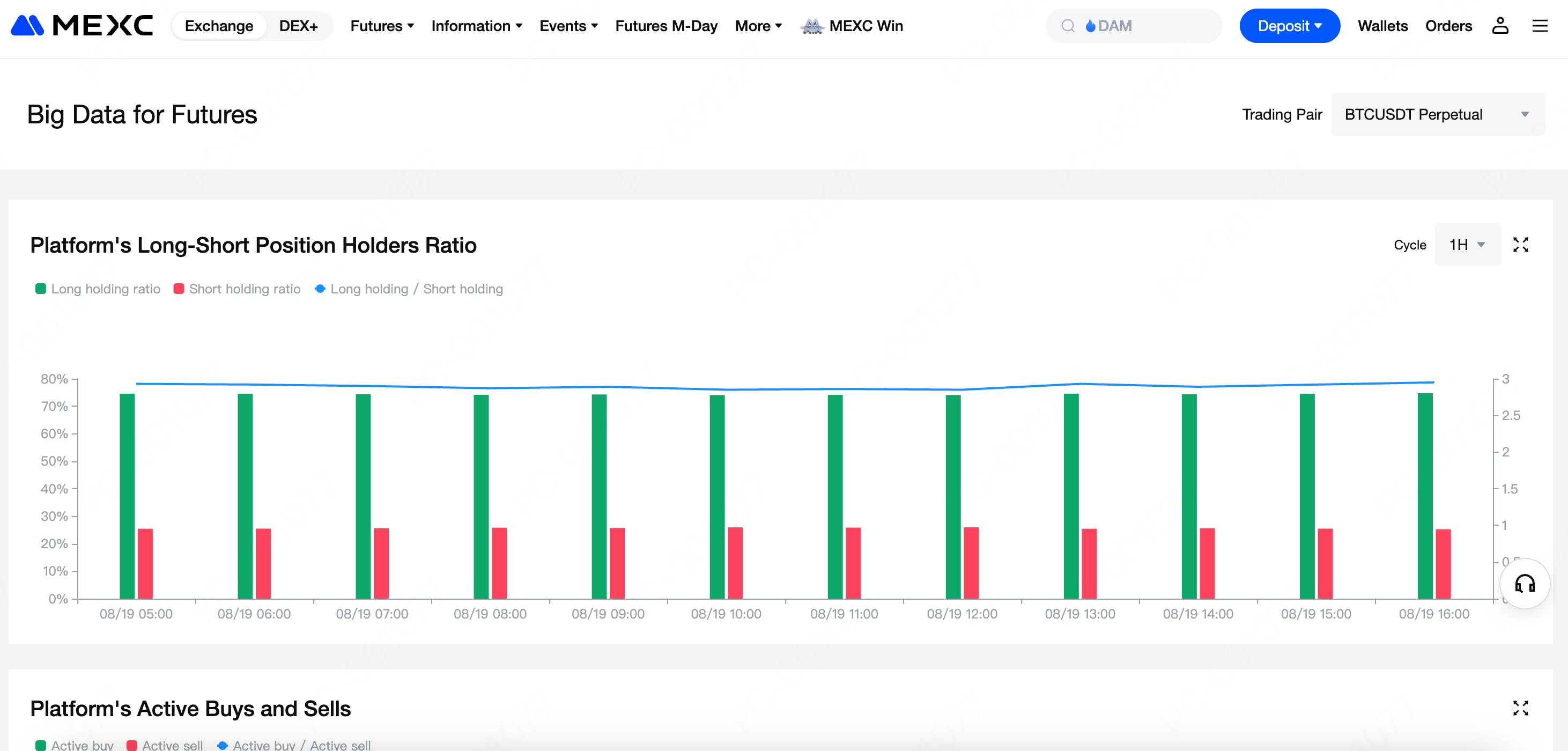

3. How to View Long/Short Ratio Data on MEXC Futures?

4. Core Features of MEXC Long/Short Ratio Data

5. How to Use MEXC Long/Short Data

5.1 Buy Signal

5.2 Sell Signal

5.3 Trend Confirmation

5.4 Divergence Signal

Recommended Reading:

- Why Choose MEXC Futures? Gain deeper insight into the advantages and unique features of MEXC Futures to help you stay ahead in the market.

- How to Participate in M-Day Learn the step-by-step methods and tips for joining M-Day and don't miss out on over 80,000 USDT in daily Futures bonus airdrops.

- MEXC Futures Trading Tutorial (App) Understand the full process of trading Futures on the app and get started with ease.

Popular Articles

When Will XRP Go Up? Technical Signals & Expert Forecasts

XRP has dropped nearly 40% from its July 2025 peak of $3.65, now trading around $2 and leaving investors wondering when the recovery will start.This article examines when XRP will go up by analyzing t

What Does XRP Stand For? The Complete Answer Explained

If you've encountered XRP in cryptocurrency discussions, you might wonder what those three letters actually mean.Unlike many crypto tickers, XRP isn't an acronym with a hidden meaning waiting to be de

Why Is XRP Going Up? Key Drivers Behind the Rally

XRP surged more than 18% in the first five days of January, breaking decisively above $2.12.This rally caught many traders off guard, but specific catalysts explain why XRP is going up right now.This

How to Trade TSLA Earnings Volatility: Profit from Price Swings on MEXC

Every quarter, the release of Tesla (TSLA) earnings reports creates a frenzy in the financial markets. For long-term investors, this is a time of anxiety as they wait to see if the company met revenue

Hot Crypto Updates

View More

Wo Ta Ma Lai Le (我踏马来了) Price Performance: Short- and Long-Term Analysis

Understanding the price performance of Wo Ta Ma Lai Le (我踏马来了) over various periods helps traders evaluate trends, identify momentum, and make informed investment decisions in the cryptocurrency

AAPL vs MSFT: Which Stock Has Delivered Better Long-Term Returns on Nasdaq?

Apple (NASDAQ: AAPL) and Microsoft (NASDAQ: MSFT) sit at the center of modern equity markets. Both are mega-cap “platform” companies with global distribution, sticky ecosystems, and the ability to

AMD vs Intel Stock: Who Wins the Next Chip Cycle?

AMD stock (NASDAQ: AMD) and Intel stock (NASDAQ: INTC) sit at the center of a long-running semiconductor rivalry that now stretches far beyond PCs. The modern contest is about data center CPUs, AI

114514 (114514) Perpetual Futures Trading Guide

Trading 114514 (114514) perpetual futures offers a way to speculate on 114514 price movements without owning the underlying cryptocurrency. MEXC perpetual futures allow traders to go long or short

Trending News

View More

Allegiant and Sun Country Airlines to Combine, Creating a Leading, More Competitive Leisure-Focused U.S. Airline

Brings Together Airlines with Similar Flexible Capacity Models Serving 22 Million Annual Customers, Nearly 175 Cities, With More Than 650 Routes, and 195 Aircraft

Ethereum (ETH) Moves Sideways as Institutional Staking Targets $3,500 Upside

Ethereum (ETH) is largely stable due to strong staking activity occurring in the background, despite a lack of price action. A major company has increased its Ethereum

Best Crypto to Buy Now as APEMARS Stage 3 Opens at $0.00002448

The post Best Crypto to Buy Now as APEMARS Stage 3 Opens at $0.00002448 appeared on BitcoinEthereumNews.com. Crypto Projects Compared to the best crypto to buy

Solana Price Swings Above $134 Low

The post Solana Price Swings Above $134 Low appeared on BitcoinEthereumNews.com. // Price Reading time: 2 min Published: Jan 11, 2026 at 20:18 Updated: Jan 11,

Related Articles

What Are Prediction Futures?

Cryptocurrency futures trading attracts countless investors with its high leverage and the ability to profit in both rising and falling markets. However, its complex mechanisms such as margin, leverag

Calculation of Futures Yield and Trading Fees

When trading futures on MEXC or other major exchanges, your trading PNL is based on three components:Trading Fees: The cost incurred during the transaction.Funding Fees: Periodic settlements based on

MEXC Fees Explained: Complete Trading, Futures & Withdrawal Fees Guide

Whether you are an experienced cryptocurrency trader or just getting started, understanding trading fees is essential to navigating the market and improving your trading experience. MEXC, a leading gl

How to Use Demo Trading on MEXC Futures

In cryptocurrency futures trading, developing skills and strategies often comes at the cost of real capital. Many beginners enter the live market without sufficient preparation and face significant lo