MEXC Fees Explained: Complete Trading, Futures & Withdrawal Fees Guide

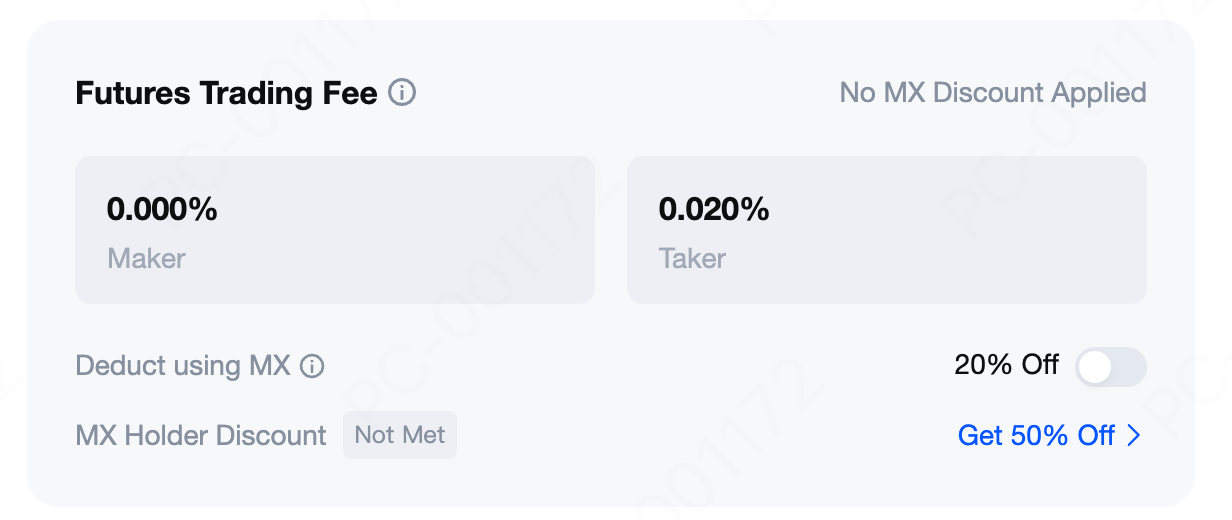

1. Futures Trading Fees

1.1 Trading Fees

- Maker: A limit order that does not immediately match with current Maker orders, but is placed in the order book as a pending order waiting to be filled. This adds liquidity to the market.

- Taker: A limit order or market order that directly matches with current Maker orders, removing liquidity from the market.

- If executed as a Maker order: Fee = 100,000 × 0.000% = 0 USDT

- If executed as a Taker order: Fee = 100,000 × 0.020% = 20 USDT

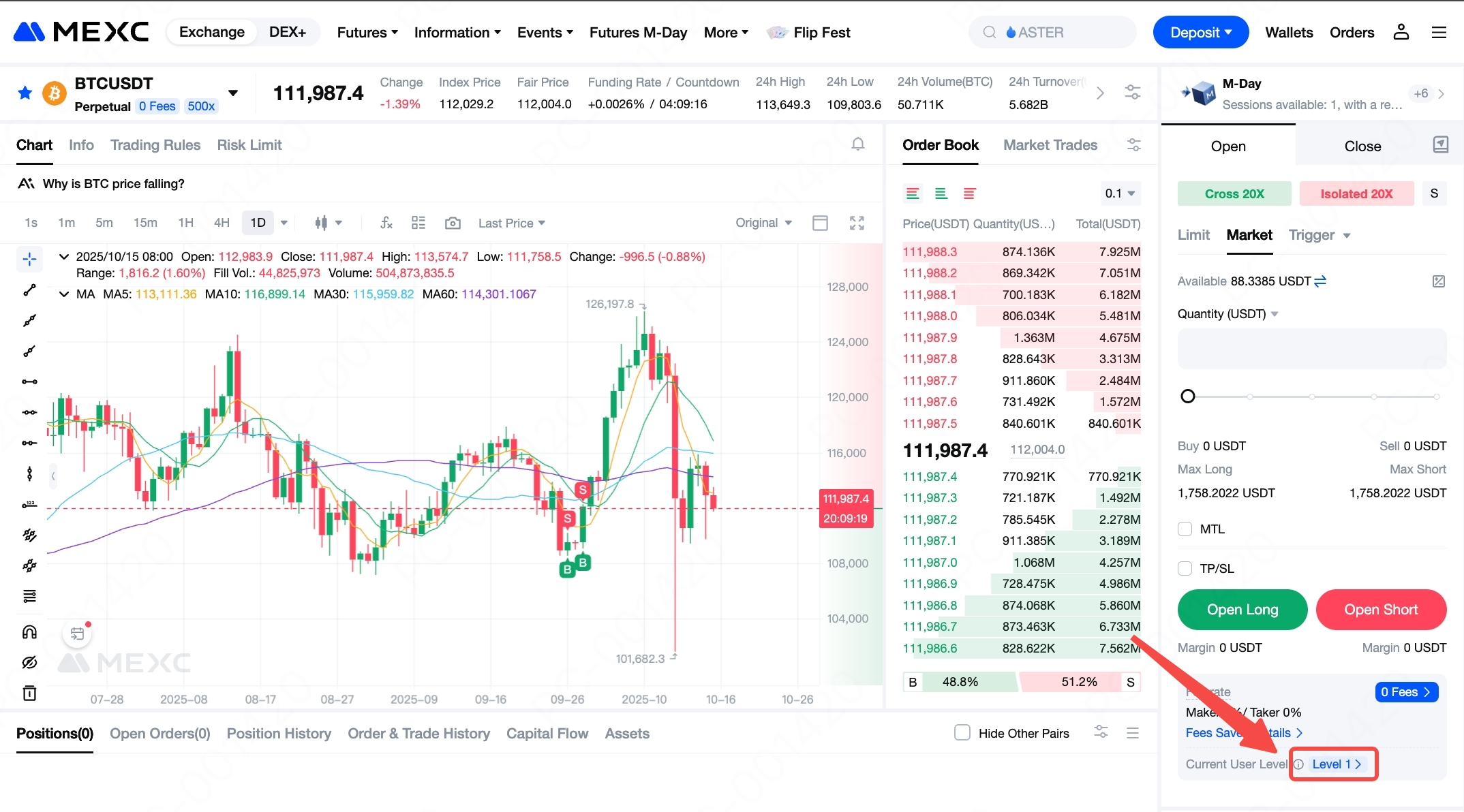

1.2 Funding Rate

- If the funding rate is positive, long positions pay funding fees while short positions receive funding fees. Conversely, if the funding rate is negative, long positions receive funding fees and short positions pay funding fees.

- Only users holding positions at the funding timestamp are required to pay or receive funding fees. If the position is closed before the funding occurs, there is no need to pay or receive funding fees.

- Because funding fee settlement requires processing time, any orders executed within ±15 seconds of the funding timestamp may not be included in the funding fee settlement. Funding fees are exchanged directly between users, and MEXC Futures does not charge any funding fees.

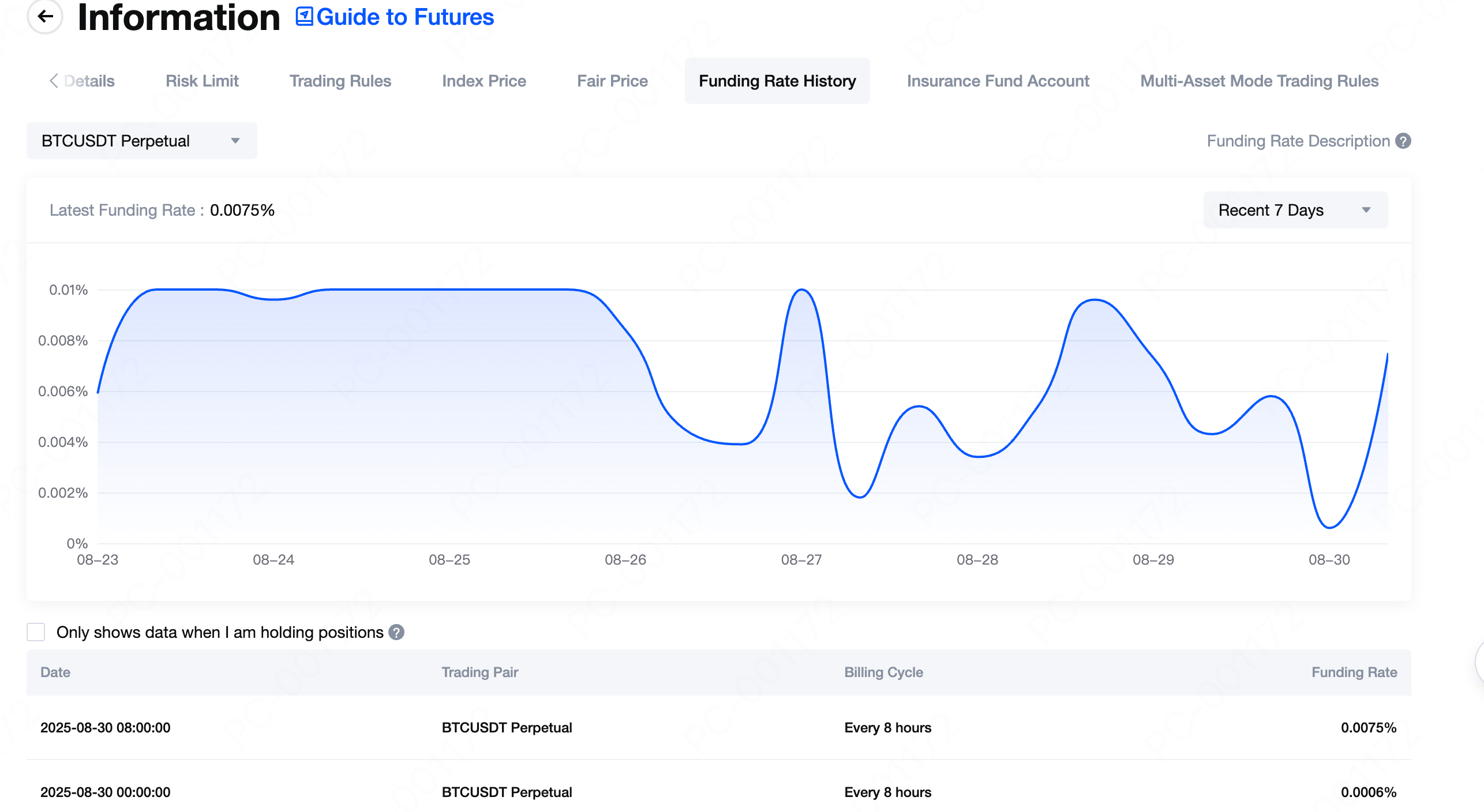

2. Spot Trading Fees

- Maker: A limit order that does not immediately match with existing Maker orders, but is placed in the order book as a pending order waiting to be filled. This adds liquidity to the market.

- Taker: A limit order or market order that directly matches with existing Maker orders, removing liquidity from the market.

- If executed as a Maker order: Fee = 100,000 × 0.0% = 0 USDT

- If executed as a Taker order: Fee = 100,000 × 0.05% = 50 USDT

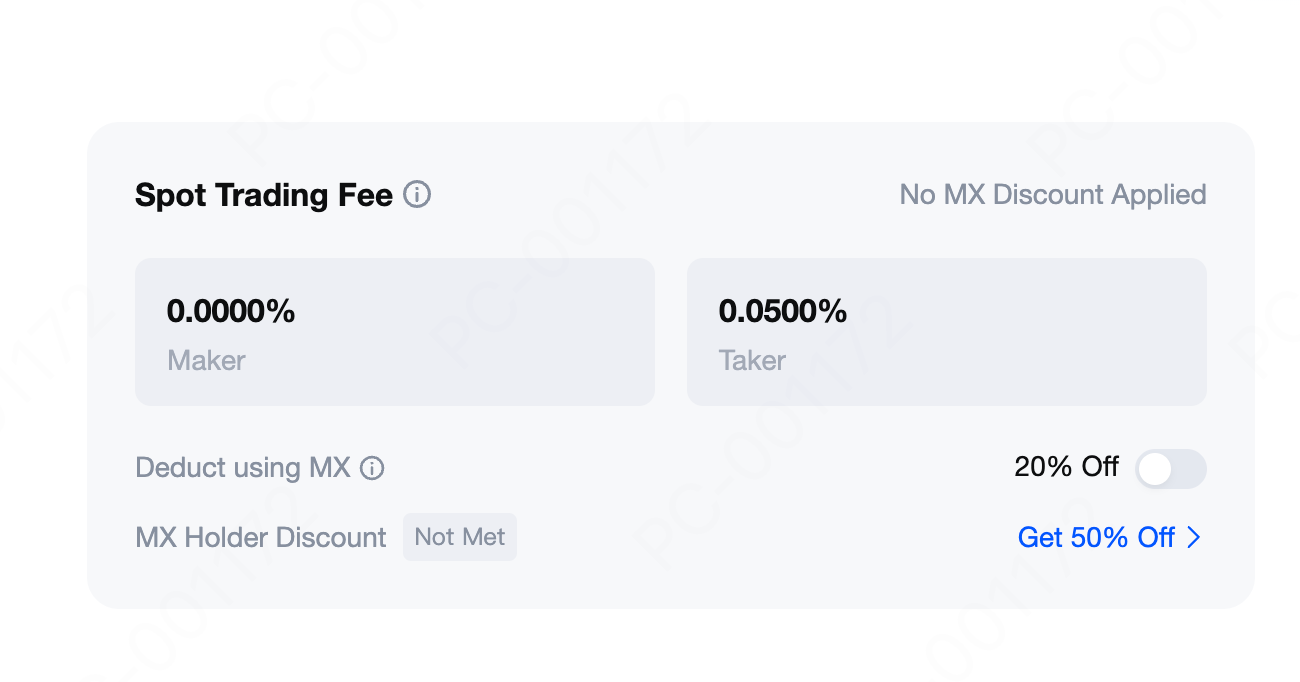

3. Four Major Benefits of Understanding Fees

- Reduce Costs: Selecting between maker and taker orders strategically, or using MX to offset fees, can meaningfully lower transaction expenses.

- Improve Strategy: Funding rates directly influence the cost of holding positions, helping traders determine whether to maintain positions over time.

- Strengthen Risk Awareness: A clear understanding of fee mechanisms helps traders avoid unnecessary losses from overlooked funding fees.

- Increase Profitability: With the same trading strategy, those who make effective use of fee structures can achieve higher net returns.

4. How to Find Trading Fee Information on MEXC

4.1 MEXC Web

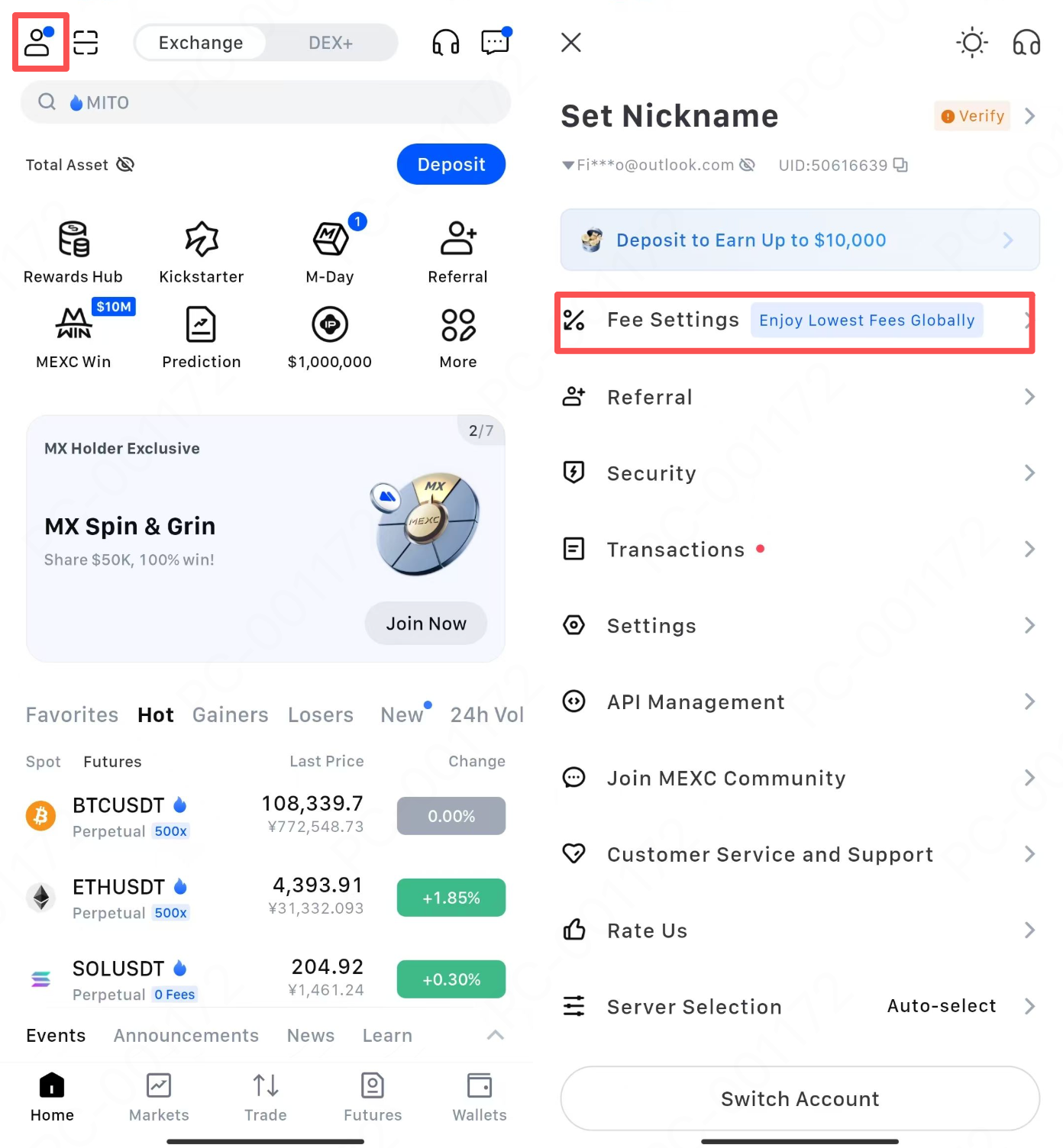

4.2 MEXC App

5. Conclusion

Recommended Reading:

- Why Choose MEXC Futures? Gain deeper insight into the advantages and unique features of MEXC Futures to help you stay ahead in the market.

- MEXC Futures Trading Tutorial (App) Understand the full process of trading Futures on the app and get started with ease.

Popular Articles

MEXC Operations Weekly Report (January 27 – February 2, 2026)

New Listings · Top Gainers · Spot & Futures Trading Data Overview Statistics Period: January 27 – February 2, 2026Release Schedule: Every ThursdayData Source: MEXC Platform, CoinGecko Last week, the c

Pi Network KYC Deadline March 14, 2025: Complete Guide to Verification

Pi Network has extended its KYC (Know Your Customer) deadline to March 14, 2025, 08:00 (UTC), marking the final opportunity for Pioneers to secure their digital assets. This last extension coincides w

Pi Network Launch Date: Complete Guide to February 2025 Mainnet Launch

After much market anticipation, Pi Network finally achieved its most significant milestone on February 20, 2025. However, with so many different "launch dates" mentioned throughout Pi Network's histor

When Will Bitcoin Go Back Up? Expert Analysis and Price Predictions

Bitcoin has pulled back from its recent highs, leaving investors wondering when the recovery will begin. This article examines short-term price signals, historical recovery patterns, and expert predic

Hot Crypto Updates

View More

How GENIUS Act Reshapes Stablecoins: Deep Dive into USAT's Transparency Revolution and Compliance Innovation

Comprehensive analysis of how USAT stablecoin achieves transparency compliance through 1:1 reserves, monthly audits, and Cantor Fitzgerald custody under the GENIUS Act, and why MEXC is the best

What Is Lighter (LIT)? Next-Generation Decentralized Trading Protocol Explained

Meta Description Comprehensive guide to Lighter (LIT) cryptocurrency: Explore its innovative order book DEX technology, tokenomics, use cases, and investment potential. Learn how to buy LIT on MEXC

What is 'npm run dev' (NPM)? An Introduction to Cryptocurrency

What Exactly is 'npm run dev' (NPM)? 'npm run dev' (NPM) is not a digital token or cryptocurrency; it is an npm (Node Package Manager) command used to execute a development script defined in a

JD Stock vs JDON Tokenized Stock: What You Really Own When You “Buy JD”

If you search “JD stock” today, you’re usually not searching for a company profile—you’re searching for a way in. A way to express a view on China’s consumption cycle, logistics power, and the long

Trending News

View More

Richtech Robotics Inc. Sued for Securities Law Violations – Contact the DJS Law Group to Discuss Your Rights – RR

LOS ANGELES–(BUSINESS WIRE)–The DJS Law Group reminds investors of a class action lawsuit against Richtech Robotics Inc. (“Richtech” or “the Company”) (NASDAQ:

PLUG Investors Have Opportunity to Lead Plug Power Inc. Securities Fraud Lawsuit with the Schall Law Firm

LOS ANGELES–(BUSINESS WIRE)–$PLUG—The Schall Law Firm, a national shareholder rights litigation firm, reminds investors of a class action lawsuit against Plug Power

Matt Hougan: Crypto winter may be ending, institutional flows are stabilizing Bitcoin, and the Clarity Act could spark a bull market

The post Matt Hougan: Crypto winter may be ending, institutional flows are stabilizing Bitcoin, and the Clarity Act could spark a bull market appeared on BitcoinEthereumNews

Rebel Republican reveals new Epstein files deal as Trump's DOJ flouts the law

Rep. Thomas Massie (R-KY), co-author of the Epstein Files Transparency Act, revealed that President Donald Trump's Department of Justice had invited him to review

Related Articles

Copy Trading Guide For Lead Traders

Copy Trading is an innovative cryptocurrency investment strategy that enables investors to automatically replicate the trades of experienced traders. For beginners lacking professional knowledge or tr

Setting Take-Profit and Stop-Loss for Futures Trading

In the cryptocurrency markets, price movements can be extremely volatile, and profits or losses can occur in an instant. For Futures traders, take-profit and stop-loss orders are not only essential to

How to Trade Futures on MEXC App: Complete Beginner's Guide

MEXC Futures trading offers MEXCers an advanced way to trade cryptocurrencies. Unlike Spot trading, Futures trading has its own unique logic and order-opening mechanisms. This article is designed to h

Spot Trading vs. Futures Trading: A Beginner's Guide to Determining Which is Right for You

As the cryptocurrency market continues to mature, the diversification of trading tools has become a key factor in building robust investment strategies. Among global mainstream crypto exchanges, MEXC