Different Types of Spot Orders

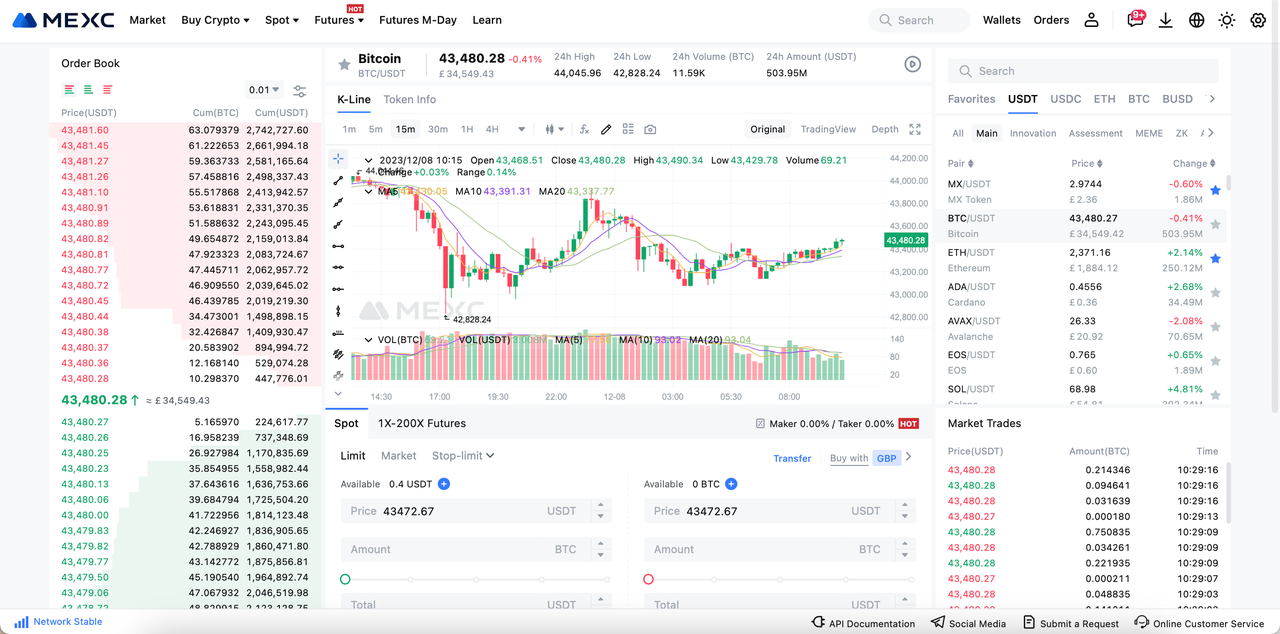

1. Limit Order

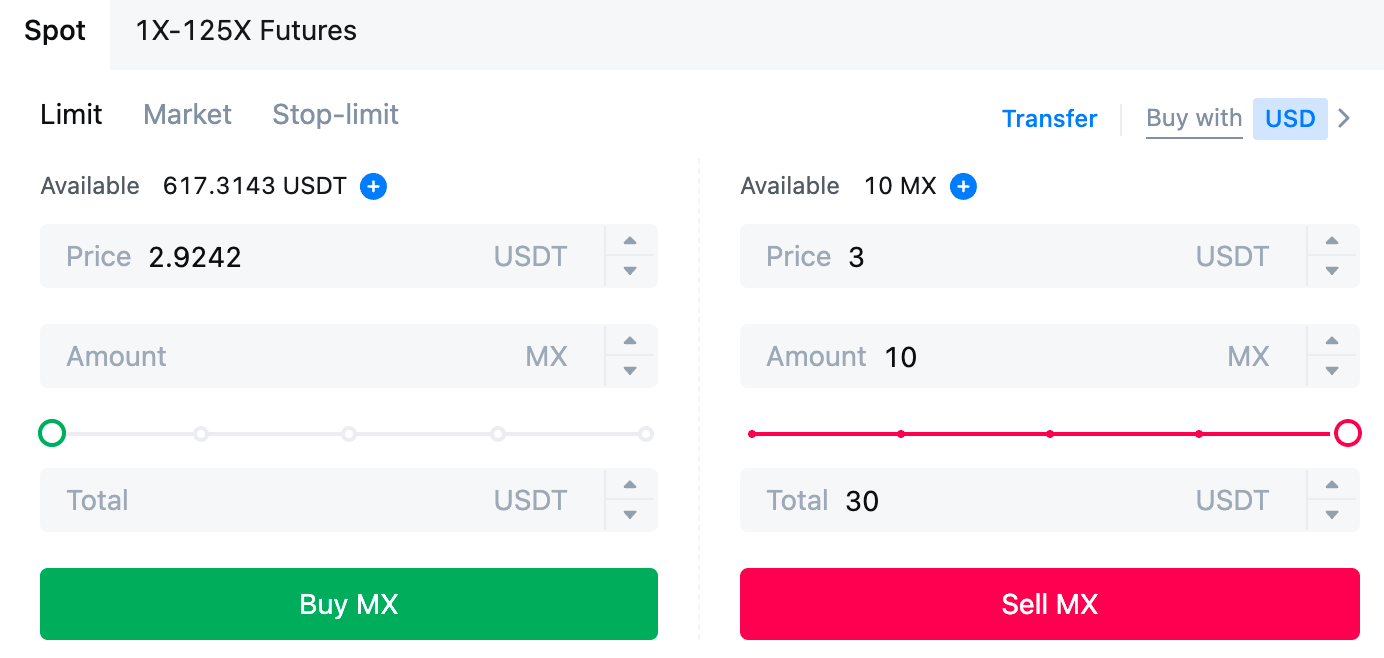

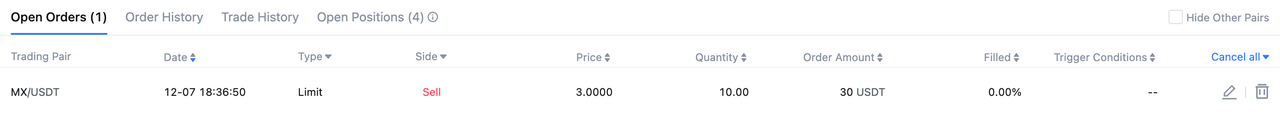

2. Market Order

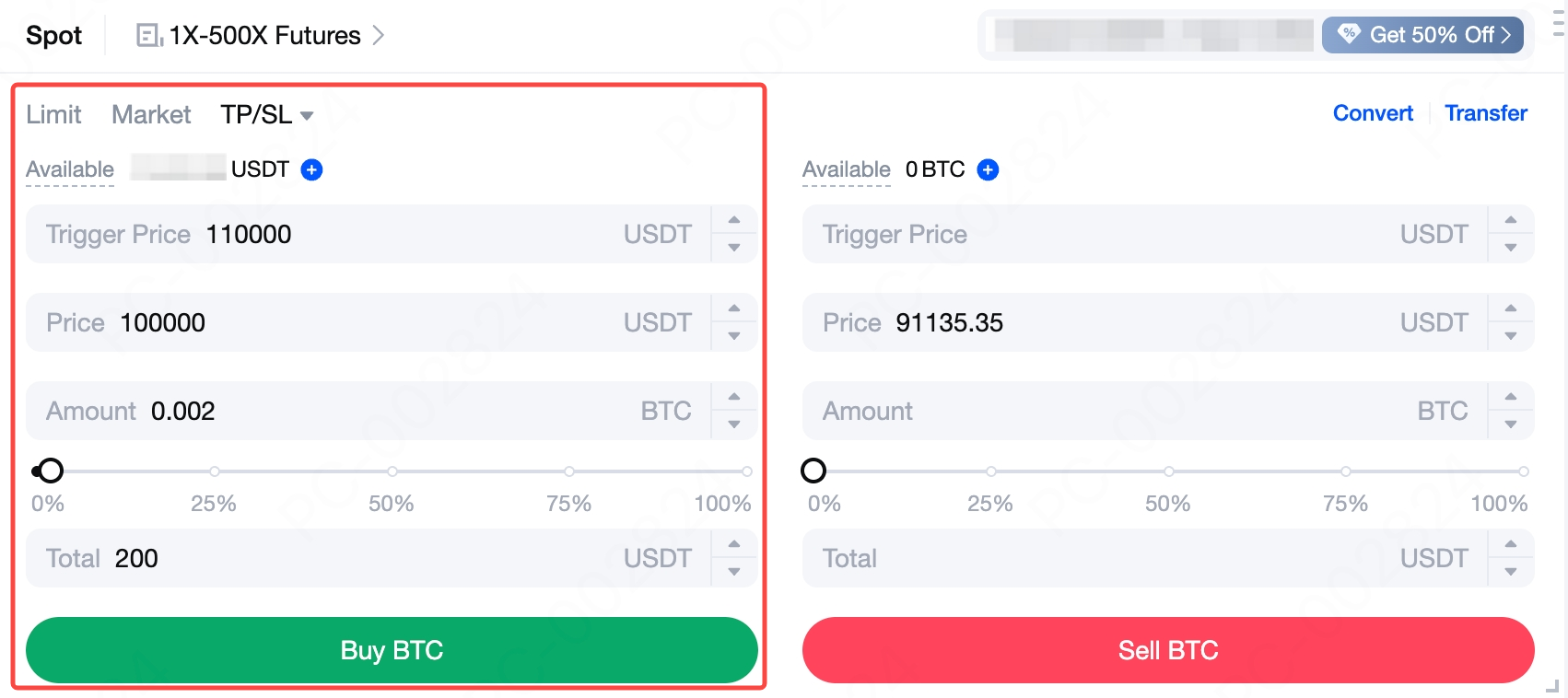

3. Take-Profit / Stop-Loss (TP/SL) Orders

- Limit TP/SL: You set both a trigger price and a limit price. When the market price reaches the trigger price, the system places a limit order at your preset price.

- Market TP/SL: You only need to set a trigger price. When the market price reaches the trigger price, the system submits a market order and executes at the best available price.

Example 1 (Stop-Limit + Stop-Loss)

You hold BTC and set a trigger price of 110,000 USDT with a limit sell price of 100,000 USDT. When the market price falls to 110,000 USDT, the system automatically places a limit sell order at 100,000 USDT, attempting to execute the stop-loss at that price.

Example 2 (Market Take-Profit)

You hold ETH and set a trigger price of 5,000 USDT. When the market price rises to 5,000 USDT, the system submits a market sell order and executes at the best available price to lock in profits.

To learn more about TP/SL orders, refer to: What Is a Take-Profit/Stop-Loss Order?

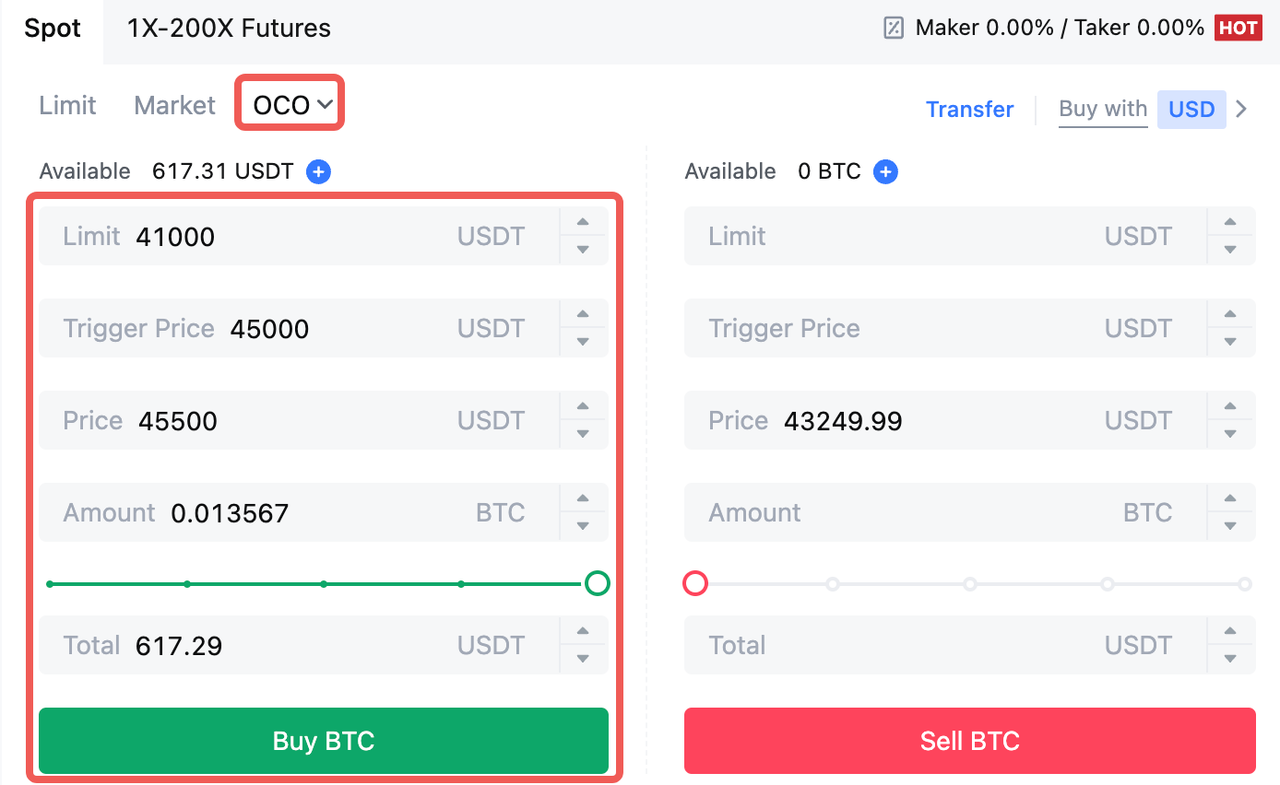

4. One-Cancels-the-Other (OCO) Order

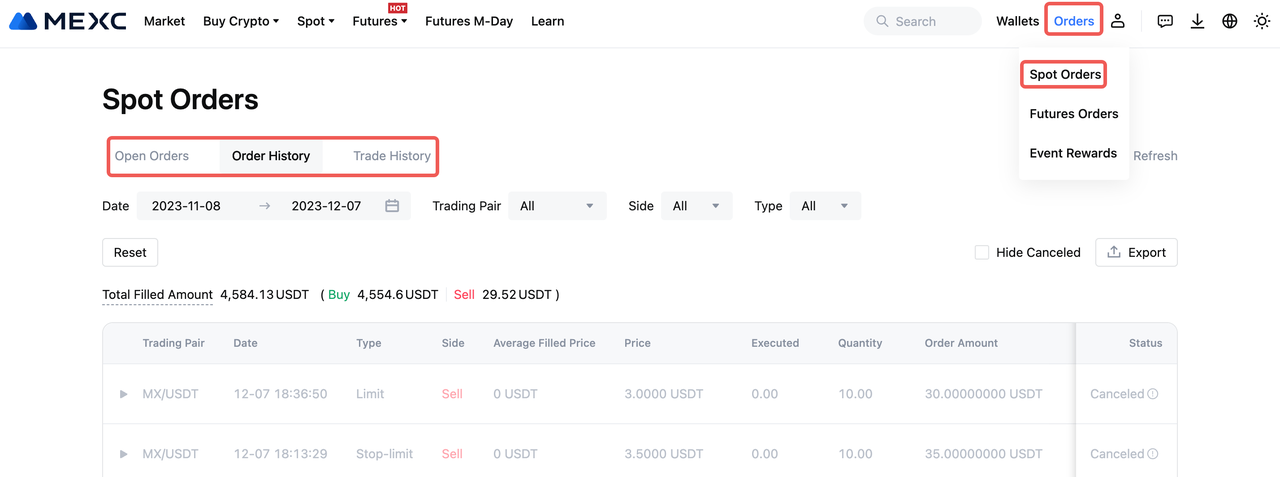

5. How To Check Order History

Popular Articles

MEXC Pre-Market Trading Guide: Complete FAQ & How to Trade Before Listing

1. What is Pre-Market TradingPre-Market Trading is an over-the-counter (OTC) service offered by MEXC. It gives traders the opportunity to buy and sell new tokens before they are officially listed on c

What is Solana Mobile (SKR)?A Blockchain-Native Smartphone Platform Bridging Hardware, dApps, and Tokenized Governance

Key Takeaways1)Solana Mobile is a hardware-first Web3 platform, integrating self-custody and blockchain security directly into smartphones.2)Saga and Seeker phones function as on-chain access devices,

What is Immunefi(IMU)? A Complete Guide to Web3's Leading Security Platform

Key Takeaways1) Immunefi focuses on continuous Web3 security coordination, not one-time audits.2) Bug bounties and audit competitions form the core of its security model.3) Magnus serves as an operati

What Is VOOI ($VOOI)? A Non-Custodial Perpetual DEX Aggregator Explained

Key Takeaways1)VOOI is a non-custodial perpetual DEX aggregator that routes trades across multiple DEXs without holding user funds.2)The platform leverages chain abstraction and intent-based execution

Hot Crypto Updates

hadtotakeprofits sir (HTTPS) Spot Trading Platform Comparison: Why MEXC Leads the Market

Choosing the right hadtotakeprofits sir (HTTPS) spot trading platform can significantly impact your trading success. MEXC stands out among cryptocurrency exchanges with superior features, competitive

Hadtotakeprofits sir (HTTPS) MEXC Spot Trading App: Your Gateway to Mobile Trading

The MEXC spot trading app revolutionizes how you trade hadtotakeprofits sir (HTTPS) with industry-leading zero maker fees and access to over 3,000 trading pairs. As one of the world's most trusted cry

hadtotakeprofits sir (HTTPS) Spot Trading Strategies: A Beginner's Guide

Spot trading involves buying and selling cryptocurrencies for immediate delivery at current market prices. For beginners looking to trade hadtotakeprofits sir (HTTPS), understanding effective spot tra

hadtotakeprofits sir (HTTPS) MEXC Spot Trading Fee: Complete Guide for Beginners

Understanding MEXC spot trading fees is crucial when trading hadtotakeprofits sir (HTTPS). MEXC operates on a maker–taker fee structure with 0% fees for makers and 0.05% fees for takers on spot market

Trending News

Buterin pushes Layer 2 interoperability as cornerstone of Ethereum’s future

Ethereum founder, Vitalik Buterin, has unveiled new goals for the Ethereum blockchain today at the Japan Developer Conference. The plan lays out short-term, mid-term, and long-term goals touching on L

Bitcoin ETF by BlackRock Draws Billions in 2025 Despite Price Decline

BlackRock Bitcoin ETF provided one of the strongest ETF performances of the year 2025, despite falling Bitcoin prices. The iShares Bitcoin Trust, IBIT, accumulated

Bitcoin Mining Stocks End Friday Strong as a Choppy Year-End Awaits

The market cap of bitcoin mining stocks climbed 9.43% on Friday, finishing the session with every one of the top ten publicly traded miners by market value in the

XRP Price Struggles Near $1.95 as Whale Inflows Hint at Exit Liquidity

The post XRP Price Struggles Near $1.95 as Whale Inflows Hint at Exit Liquidity appeared on BitcoinEthereumNews.com. Since July 2025, the XRP price witnessed a

Related Articles

MEXC Spot Trading Fees: Maker & Taker Rates Calculator

Key Takeaways MEXC charges 0% maker fees and 0.05% taker fees for spot trading, making it highly cost-effective for liquidity providers. MX token holders with 500+ tokens for 24 hours receive a 50

MEXC Loans is Now Live!

MEXC Loans is a cryptocurrency lending solution introduced by MEXC. MEXC Loans allows users to collateralize one of their cryptocurrency assets to borrow another that they can then use for spot tradin

Spot Trading vs. Futures Trading: A Beginner's Guide to Determining Which is Right for You

As the cryptocurrency market continues to mature, the diversification of trading tools has become a key factor in building robust investment strategies. Among global mainstream crypto exchanges, MEXC

Spot Market Trading Rules

In cryptocurrency spot trading, beyond price analysis and strategy selection, understanding and following the trading platform's market rules is equally crucial. For MEXC users, each trading pair not